Existing net price (NAV) after tax at an actual rate of $8% of $683 million.

Genuine internal rate of return (TIR) after tax of 35.3%.

Transfer recovery after 2.2 years tax.

Pre-production capital costs, including contingency, of $337 million.

Existing surface and underground infrastructure makes it possible to particularly reduce capital prices than new facility progression projects.

The average production of zinc over the life of the 381,000-tonne dry mine consistent with the year, with a 59% zinc content, is expected to place Kipushi, once in production, among the world’s largest zinc mines.

All figures are allocated 100 per cent, unless otherwise stated. The estimated average monetary cost over the life of the $0.48/lb zinc mine is expected to place Kipushi, once in production, in the rear quartile of the spot cost curve for foreign zinc producers.

Kipushi DFS’s assignment is in the final stages and some facets of the design have been moved to a detailed engineering phase.

Figure 17: Samuel Ndembo (left) and Mbiya Africa (right) taking airflow measurements at the Kipushi electric substation at 850 meters.

https://orders.newsfilecorp.com/files/3396/61360_2569658254345a27_021full.jpg “data-reactid” 358 “To see a preview of Figure 17, visit: https://orders.newsfilecorp.com/files/ 3396 / 61360_2569658254345a27_021full.jpg

Project and infrastructure

Although progression and rehabilitation activities in the six months ended in June 2020 have been limited, significant progress has been made in the modernization of the Kipushi mine’s underground infrastructure in recent years as a component of the mine’s resumption of advertising production, adding the modernization of a series of vertical mineholes in depths. Matrix with related head frames, as well as excavations and underground mine infrastructure. A number of cross-sections and ventilation infrastructure are still in operation and have been cleaned of old fabrics and appliances to facilitate modern and mechanized bulk mining. The underground infrastructure also includes a number of high-capacity pumps to manage the mine’s water levels, which are now easy to maintain at the back of the mine.

Well five is 8 meters in diameter and 1,240 meters deep and has been improved and put back into service. Most of the body of workers and appliances has been updated and modernized to meet foreign industry criteria and protection criteria. The Shaft Five Rock Lift is also fully operational with new containers, new head and tail cables and installed accessories. The two rock conveyors (bennes) and the newly manufactured frames (girlfriends) were installed in the well to facilitate the lifting of the main mineral rock and the silos of the waste garage that supply the rock at 1200 meters.

The main shipping address at 1150 meters, between the Big Zinc access descent and the rock loading facilities of well 5, has been remade with concrete so that the mine can use modern cellular machines without rails. A new truck flip container has been installed at this level, which feeds the large capacity rock shredder directly below. The old P2 well winder was undone and the structure of the new base, as well as the meeting and installation of the new fashion winder, were finished and fully implemented after passing inspection and protection testing procedures.

4. The West Foreland Exploration Project of the Democratic Republic of the Congo is 100 percent owned through Ivanhoe Mines Democratic Republic of the Congo

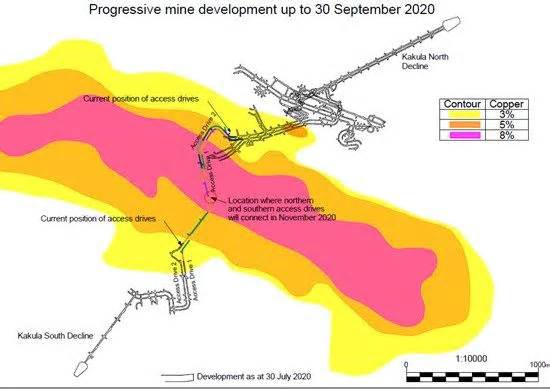

Ivanhoe Exploration Group in the Democratic Republic of the Congo aims at the kamoa-Kakula copper mineralization through a regional exploration and drilling programme on its 100 percent Western Foreland exploration licences, located north, south and west of the Kamoa-Kakula allocation. Exploration activities in Western Foreland’s exploration allocation in the Democratic Republic of the Congo will continue with a budget of $8 million by 2020, of which approximately $4.5 million remains for the rest of the year.

In the first quarter of 2020, six surveys were drilled in The Makoko’s prospectus, totaling 2103 metres. At the end of the first quarter, drilling was suspended in Western Foreland’s exploration licenses due to torrential rains preventing access to drilling sites and in reaction to the company’s preventive measures to protect its COVID-19 painters and drilling contractors. During the last quarter of 2020, the geology team began exploring 8 new Ivanhoe Mines exploration licenses (PR14543 – PR14550) in the Western Foreland area. These paintings concerned the creation of an exploration center on each permit and the final touch of a minimum of 10 days of geological paints on the ground, focusing on channel mapping and sampling of boxes and sampling of streams and point samples. Follow-up paintings on permits PR14546 and PR14547 continued after seven exploration reports were submitted to the government of the Democratic Republic of the Congo.

High-solution satellite images, aster knowledge, and 2.5-meter solution virtual elevation style knowledge (DEM) were purchased from the Western Foreland Licensing Area. Planning for a high-solution magnetic and radiometric lift has been completed and plans are being made for a gravitational lift in the air. Both geophysical studies are expected to begin in the third quarter of 2020. The purpose of these paintings is to perceive the magnetic and density characteristics of the other lythologies and stratigraphies of the exploration area.

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes the monetary data decided over the last 8 quarters. Ivanhoe did not record any operational sources of income in an era of monetary reporting and did not report or pay dividends or distributions in an era of monetary reporting.

Table 1

https://orders.newsfilecorp.com/files/3396/61360_2569658254345a27_022full.jpg “data-reactid” 378 “To see a preview of Table 1, visit: https://orders.newsfilecorp.com/files/ 3396 / 61360_2569658254345a27_022full.jpg

DISCUSSION OF THE RESULTS OF OPERATIONS

Three months ended June 30, 2020 compared to June 30, 2019

The company reported a general revenue stream of $0.3 million for the current quarter of 2020, compared to a profit of $8.1 million for it in 2019.

The salaries and benefits of $5.1 million for the 3 months ended June 30, 2020 were $2.8 million for the same era in 2019. The increase due to severance pay paid to senior outgoing executives as the company reduced its senior control workforce. This is partially offset by voluntary wage discounts agreed through the remaining control.

Financial revenues for the second quarter of 2020 were $18.7 million and were $1.8 million more than for the same time in 2019 ($16.9 million). Financial income comes from interest accrued on loans to the Kamoa Holding joint venture to finance transactions amounting to $16.4 million by the time of the 2020 quarter and $12.7 million for the same time in 2019, with interest expanding as the accumulated loan balance increases. Interest earned in money and money equivalents decreased due to interest rate cuts through the U.S. Federal Reserve, even though the company had a higher monetary balance at the time of the 2020 quarter.

Exploration and allocation expenses were $9.0 million in the second quarter of 2020 and $3.3 million for the same time in 2019. While all exploration and allocation costs incurred in the second quarter of 2019 were similar to exploring The Western Foreland’s exploration licenses that were 100 percent to Ivanhoe, the second quarter of 2020 also included $7.5 million spent on Kipushi’s allocation, resulting in limited capital prices during the quarter due to reduced operations. The main categories of kipushi allocation spending in the second quarter of 2020 and the second quarter of 2019 are presented in the following table:

Table 2

https://orders.newsfilecorp.com/files/3396/61360_2569658254345a27_023full.jpg “data-reactid” 394 “To see a preview of Table 2, visit: https://orders.newsfilecorp.com/files/ 3396 / 61360_2569658254345a27_023full.jpg

The percentage of Kamoa Holding joint venture losses increased from $6.2 million in the second quarter of 2019 to $6.6 million in the second quarter of 2020. The following table summarizes the Company’s percentage of Kamoa Holding’s losses for the 3 months ended June 30, 2020 and for the same time in 2019:

“data-reactid” 396″

Table 3

https://orders.newsfilecorp.com/files/3396/61360_2569658254345a27_024full.jpg “data-reactid” 406 “To see a preview of Table 3, visit: https://orders.newsfilecorp.com/files/ 3396 / 61360_2569658254345a27_024full.jpg

The financing prices of the Kamoa Holding joint venture are similar to percentage holder loans where the percentage holder must finance Kamoa Holding in an amount equivalent to its proportional percentage share. The percentage of the Crystal River corporate complex on your behalf in exchange for an accrual on the order price ticket due to Ivanhoe.

Results for the six months ended June 30, 2020 to June 30, 2019

The Company recorded an overall total loss of $76.3 million for the six months ended June 30, 2020, with a profit of $11.5 million for it in 2019. The overall loss for the six months ended June 30, 2020 included a foreign exchange loss on the conversion of foreign trades of $53.9 million, result of the weakening of the South African rand by 24% from December 31, 2019 to June 30, 2020, to a foreign exchange gain recorded for the same time in 2019 of $5.8 million.

Financial revenues for the six months ended June 30, 2020 were $39.5 million and $6.8 million higher than the six months ended June 20, 2020 ($32.7 million). Financial income comes from interest accrued on loans to the Kamoa Holding joint venture to finance transactions amounting to $32.7 million for the six months ended June 30, 2020 and $24.7 million for it was in 2019, with higher interest rates as the accumulated loan balance is higher. . Interest earned in money and money equivalents for the six months ended June 30, 2020 $3.5 million and $2.6 million less than for the same time in 2019 ($6.1 million).

Exploration and allocation expenses were $21.0 million for the six months ended June 30, 2020 and $4.7 million for it was in 2019. While all exploration and allocation expenses incurred in 2019 were similar to exploring the exploration licenses of The Western Foreland IvanhoeArray 2020 also included $17.5 million spent on Kipushi’s allocation, which concerned cutting operations and incurring limited capital prices in the year to date. The main categories of expenses of Kipushi’s allocation for the six months ending June 30, 2020 and for the same time in 2019 are presented in the following table:

Table 4

https://orders.newsfilecorp.com/files/3396/61360_2569658254345a27_025full.jpg “data-reactid” 421 “To see a preview of Table 4, visit: https://orders.newsfilecorp.com/files/ 3396 / 61360_2569658254345a27_025full.jpg

Kamoa Holding’s joint venture loss rate increased from $12.1 million for the six months ended June 30, 2019 to $13.3 million for the same era in 2020. The following table summarizes the percentage of losses of the company’s Kamoa Holding during the six months. June 30, 2020 and for the same time in 2019:

Table 5

https://orders.newsfilecorp.com/files/3396/61360_2569658254345a27_026full.jpg “data-reactid” 432 “To see a preview of Table 5, visit: https://orders.newsfilecorp.com/files/ 3396 / 61360_2569658254345a27_026full.jpg

Financial data as of June 30, 2020 vs. December 31, 2019

The Company’s total assets decreased through $76.7 million from $2,444.7 million as of December 31, 2019 to $2,368.0 million as of June 30, 2020. The Company used $37.5 million of its monetary resources in its operations and earned $3.5 million in interest on money and money equivalents in the six months ended June 30, 2020.

Properties, plant and appliances minimized through $34.0 million from $421.1 million as of December 31, 2019 to $387.1 million as of June 30, 2020. Minimize the conversion of foreign currency from non-dollar activities of $51.6 million due to the weakening of the South. African Rand up to 24% from 31 December 2019 to 30 June 2020. A total of $19.8 million spent on allocation progression and other tangible assets, of which $18.5 million is similar to the progression and other acquisitions of property assets, plant and appliances to the Platreef allocation.

The main parts of tangible asset additions, adding up the capitalized progression prices, of Platreef’s allocation for the six months ended June 30, 2020 and for the same era in 2019 are presented in the following table:

Table 6

https://orders.newsfilecorp.com/files/3396/61360_2569658254345a27_027full.jpg “data-reactid” 446 “To see a preview of Table 6, visit: https://orders.newsfilecorp.com/files/ 3396 / 61360_2569658254345a27_027full.jpg

Prices incurred under Platreef’s allocation are considered mandatory to bring the allocation to advertising production and are capitalized as tangible assets.

The Company’s investment in the Kamoa Holding joint venture increased through $162.4 million, from $912.6 million as of December 31, 2019 to $1075.0 million as of June 30, 2020, and each of the existing percentage shareholders financing the transactions amounts to its proportional percentage share. The Company’s share of the Kamoa Holding joint venture requires a budget of $143.0 million in the six months ending June 30, 2020, while the company’s share of the joint venture’s losses is $13.3 million.

The company’s investment in the Kamoa Holding joint venture can be broken down as follows:

Table 7

https://orders.newsfilecorp.com/files/3396/61360_2569658254345a27_028full.jpg “data-reactid” 459 “To see a preview of Table 7, visit: https://orders.newsfilecorp.com/files/ 3396 / 61360_2569658254345a27_028full.jpg

The Kamoa Holding joint venture mainly uses complex loans through its percentage shareholders to advance the Kamoa-Kakula allocation by investing in progression prices and other tangible assets, as well as continuous exploration. This can be demonstrated through the evolution of the percentage of the company’s net assets in the Kamoa Holding joint venture, which is broken down as follows:

Table 8

https://orders.newsfilecorp.com/files/3396/61360_2569658254345a27_029full.jpg “data-reactid” 470 “To see a preview of Table 8, visit: https://orders.newsfilecorp.com/files/ 3396 / 61360_2569658254345a27_029full.jpg

The net accumulation in tangible assets of the Kamoa Holding joint venture from December 31, 2019 to June 30, 2020 $224.9 million and may be damaged as follows:

Table 9

https://orders.newsfilecorp.com/files/3396/61360_2569658254345a27_030full.jpg “data-reactid” 481 “To see a preview of Table 9, visit: https://orders.newsfilecorp.com/files/ 3396 / 61360_2569658254345a27_030full.jpg

The Company’s general liabilities were minimized through $10.1 million to $71.8 million as of June 30, 2020, to $81.9 million as of December 31, 2019, due to a minimisation of $10.4 million from suppliers and other creditors.

LIQUIDITY AND CAPITAL RESOURCES

The Company had $496.2 million in money and money equivalents as of June 30, 2020. At the time, the Company had a consolidated working capital of approximately $544.8 million, at $688.5 million as of December 31, 2019.

As of December 8, 2015, Kamoa Holding’s shareholder is required to finance Kamoa Holding in an amount equivalent to its proportional shareholding. The percentage of the Crystal River corporate complex on your behalf in exchange for an accrual on the order price ticket due to Ivanhoe.

The Platreef Project’s current expenditure is being funded solely by Ivanhoe, through an interest bearing loan to Ivanplats, as the Japanese consortium has elected not to contribute to current expenditures.

The company is in the process of cutting its global presence and controlling and controlling the workforce, as well as implementing several other cash-saving measures across the enterprise. Ivanhoe’s head will remain in Sandton, South Africa, and will be supported by satellites in Beijing, China and London, UK. The company plans to spend $11.1 million on overheads for the remainder of 2020.

Ivanhoe’s board of directors has allocated a reduced budget for 2020 of $41.7 million for The Allocation of Platreef, of which $23.4 million is allocated for the remainder of 2020, when the sinking of Platreef’s well 1 was recently completed. The company also allocated a reduced budget for 2020 of $28.7 million for Kipushi’s allocation, of which $13.5 million is allocated for the remainder of 2020. Exploration activities in Western Foreland’s exploration allocation in the Democratic Republic of the Congo will continue with a 2020 budget of $8.0 million, which is allocated $4.5 million for the remainder of 2020. In the Kamoa-Kakula allocation, the priority remains the continuation of the progression paints at the Kakula mine, where initial production of copper concentrate is expected in the third quarter of 2021. The company has budgeted $257 million for its proportional investment of the Kamoa-Kakula allocation for the remainder of 2020.

As Ivanhoe continues to advance its allocations, company control has reviewed and evaluated opportunities to finance its percentage of kakula copper mine structure prices and to advance exploration and progression allocations in its other allocations in Southern Africa. These opportunities include, but are not limited to, existing liquidity resources, money addition, receivables and investments, asset sales, allocation financing, flow or royalty transactions, device financing, and debts. While Ivanhoe hopes to continue to have enough money or financing characteristics related to the allocation to cover its percentage of the initial capital prices at the Kakula mine, the Company will continue to seek and explore the opportunities presented to Ivanhoe, taking into account Ivanhoe’s more productive opportunities. Ivanhoe’s interests and activities and monetary position. Fix industry situations and geopolitical considerations.

www.ivanhoemines.com and www.sedar.com. This press release should be read in conjunction with The unaudited consolidated interim monetary statements of Ivanhoe Mines and the three- and six-month control report ended June 30, 2020, available in www.ivanhoemines.com and www.sedar.com.

Qualified person

Scientific or technical disclosures related to the revised capital expenditure of Kamoa-Kakula and the progression scenarios in this press release were reviewed and approved through Steve Amos, who is Array due to his training, delight and pro-association, Qualified Person under Regulation 43-101. Mr Amos is not independent under Regulation 43-101 because he is the head of the Kamoa project. Mr. Amos verified the technical knowledge disclosed in this press release.

Other disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation. Mr. Torr has verified the other technical data disclosed in this news release.

www.sedar.com: “data-reactid 494” – Ivanhoe has prepared a current, independent technical report and NI 43-101 for each of the Platreef, Kipushi and Kamoa-Kakula projects, which will be held under the SEDAR of the company profile in www.sedar.com:

The Kamoa-Kakula 2020 resource update of March 25, 2020, is scheduled through OreWin Pty Ltd., Wood plc, DRA Global, SRK Consulting (South Africa) (Pty) Ltd and Stantec Consulting International LLC, which covers the company’s Kamoa-Kakula project;

The technical feasibility report of Platreef 2017 dated September 4, 2017, ready through DRA Global, OreWin Pty.Ltd., Amec Foster Wheeler, Stantec Consulting, Murray – Roberts Cementation, SRK Consulting, Golder Associates and Digthrough Wells Environmental, covering the Platreef Project; And

The 2019 Update of Mineral Resources from Kipushi 2019, available through OreWin Pty Ltd., MSA Group (Pty) Ltd., SRK Consulting (South Africa) (Pty) Ltd. and MDM (Technical) Africa Pty Ltd. (a department) of Wood PLC), which covers the company’s Kipushi project.

www.sedar.com. “knowledge-reactid” 499 “: these technical reports include applicable data related to the dates of validity and assumptions, parameters and strategies for estimating mineral resources in the Allocation of Platreef, the allocation of Kipushi and the Kamoa-Kakula project cited in this press release, as well as data on knowledge verification, exploration procedures and other clinical and technical disclosure problems related to plaftree assignment. Organize Kipushi’s assignment and Kamoa-Kakula assignment. Additional company data will be included in addition to the company’s annual notice. I had in SEDAR in www.sedar.com.

Information contacts

Bill Trenaman Investors – 1,604,331,9834

MediaMatthew Keevil 1.604. 558.1034

www.ivanhoemines.com “data-reactid” 503 www.ivanhoemines.com “

Forward-looking statements

Certain statements contained in this press release constitute “forward-looking statements” or “future data” within the meaning of applicable securities laws. These statements and data involve known and unknown risks, insecurities, and other points that may also cause actual effects, functionality or achievements, projects or effects of the company’s industry to differ materially from the effects, functionality, or long-term accomplishments expressed or implied. forward-looking statements or data. These statements can be known by using words such as “possibly,” “could,” “you can just,” “will,” “pretend,” “expect,” “believe,” “plan,” “anticipate,” “” “estimate”,” plan,” predict “,” and other terms,” or imply that certain actions, occasions or effects” may possibly “also” Array “may” “be” “These statements reflect the Company’s existing expectations regarding long-term events, functionality and effects and refer only to the date of the Company’s control report at the time of the 2020.

Such statements include without limitation, the timing and results of: (i) statements regarding first copper concentrate production at the Kakula Mine in Q3 2021; (ii) statements regarding the pace of underground development at the Kakula Mine is expected to continue to accelerate as additional mining crews are mobilized; (iii) statements regarding Kakula’s high-grade stockpile is projected to significantly expand in the coming months as the majority of Kakula’s underground development will be in mining zones grading +5% copper; (iv) statements regarding the expectation that Kakula’s high pressure grinding rolls (HPGR), flotation cells and thickeners are expected to arrive on site before the end of August 2020; (v) statements regarding refurbishment of six turbines at the Mwadingusha hydro-electric power plant and associated 220-kilovolt infrastructure is progressing and that three turbines are expected to be operational by December 2020, the remaining three in Q1 2021, and the refurbished plant is projected to deliver approximately 72 megawatts of power to the national grid; (vi) statements regarding a phased development production plan for the Platreef Project that targets significantly lower initial capital, to accelerate first production by using Shaft 1 as the mine’s initial production shaft, followed by expansions to the production rate as outlined in the 2017 definitive feasibility study (DFS); (vii) statements regarding the planned expansion in initial plant capacity at Kakula from 3.0 Mtpa to 3.8 Mtpa and the planned increase in the underground mining crews in 2020 from 11 to 14 to ensure sufficient mining operations to feed the expanded plant throughput; (viii) statements regarding the updated estimate of Kakula’s initial capital costs is approximately $1.3 billion as of January 1, 2019, which assumes commissioning of the processing plant in Q3 2021 and includes expanded plant capacity and pre-production ore stockpiles; (ix) statements that the Kamoa-Kakula joint venture had an estimated $750 million of capital costs remaining until initial production; (x) statements regarding the planned mining methods at Platreef will use highly productive, mechanized methods, including long-hole stoping and drift-and-fill mining, and that each method will utilize cemented backfill for maximum ore extraction; (xi) statements regarding an independent DFS for the Kakula Mine is well advanced and is expected to be finalized shortly, and at the same time, Ivanhoe expects to issue an Integrated Development Plan for the entire Kamoa-Kakula mining complex, which will include details on the planned expansion phases for the greater Kamoa-Kakula mining complex, incorporating updates for mineral resources, production rates and economic analysis; (xii) statements regarding the forthcoming Kakula DFS will incorporate detailed design, engineering and procurement, with the plans to increase the initial processing plant ore capacity from 3.0 Mtpa to 3.8 Mtpa; (xiii) statements regarding Ivanhoe’s expectation that it will continue to have sufficient cash resources or project-related financing options available to cover its share of the initial capital costs; (xiv) statements regarding timing and duration of reduced activities at the Platreef and Kipushi projects; (xv) statements regarding the expected expenditure for the remainder of 2020 of $23.4 million on further development at the Platreef Project; $13.5 million at the Kipushi Project; $4.5 million on regional exploration in the DRC; and $11.1 million on corporate overheads – as well as its proportionate funding of the Kamoa-Kakula Project, expected to be $257 million for the remainder of 2020.

In addition, all the effects of the Prefeasibility Review of the Kakula Copper Mine and the updated and expanded initial economic assessment of the Kamoa-Kakula allocation, Platreef’s feasibility review and Kipi’s prefeasibility review are forward-looking statements or data, and come with long-term estimates of internal rates of return , net charge Arrange long-term production, estimates of monetary charges, proposed mining plans and methods, mine life estimates, monetary forecasts, steel recoveries, capital estimates and operating charges, and the duration and timing of slow allocation progression. In addition, with respect to this forward-looking express data related to the progression of the assignments of Kamoa-Kakula, Platreef and Kipushi, the company has founded its assumptions and investigations on certain points that are inherently insecure. Insecurities come with: (i) adequacy of infrastructure; (ii) geological characteristics; (iii) the stereo-metallurgical characteristics of mineralization; (iv) the ability to expand a sufficiently good processing capacity; (v) the value of copper, nickel, zinc, platinum, palladium, rhodium and gold; (vi) the availability of devices and amenities necessary to complete the progression; (vii) the loading of consumables and extraction and processing apparatus; (viii) unforeseen technological and technical problems; (ix) injuries or acts of sabotage or terrorism; (x) currency fluctuations; (xi) regulatory adjustments; (xii) compliance through the joint venture partners with the terms of the agreements; (xiii) the availability and productivity of professional work; (xiv) the regulation of the mining industry through various government agencies; (xv) the ability to raise enough capital to expand such allocations; (xiv) adjustments in the scope or design of the assignment, and (xv) political points.

This press release also includes references to mineral resource estimates and mineral reserves. The estimation of mineral resources is inherently dubious and comes to subjective judgments on many applicable factors. Mineral reserve estimates provide more certainty, but still involve similar subjective judgments. Mineral resources that are not mineral reserves have not demonstrated their economic viability. The accuracy of these estimates is based on the quantity and quality of knowledge available, as well as the assumptions and judgments used in geological engineering and interpretation (adding up the estimated long-term production of the company’s projects, the tonnages and expected laws to be exploited). .and the estimated recovery point to be achieved), which would possibly prove unreliable and possibly in some way have research into the effects of drilling and statistical inferences that may ultimately prove inaccurate. Estimates of mineral resources or mineral reserves may wish to be re-estimated based on: (i) fluctuations in costs of copper, nickel, zinc, platinum organization (PGE), gold or other minerals; (ii) drilling effects; (iii) metallurgical evidence and other studies; (iv) proposed mining operations, adding dilution; (v) the evaluation of mining plans after the date of any estimate and/or adjustments to mining plans; (vi) the option not to receive the required permissions, approvals and licenses; (vii) adjustments to the law or regulations.

Forward-looking statements and data involve significant dangers and uncertainties, do not deserve to be construed as promises of functionality or long-term effects, and will not necessarily be express signs of whether such effects are achieved or not. Several points may cause the actual effects to differ materially from the effects discussed in the forward-looking statements or data, including but not limited to the points described under and under “Risk Factors” and elsewhere in the Company’s control report. for the 3 and six months ended June 30, 2020, as well as unforeseen adjustments to legislation, regulation or regulation, or compliance through the relevant authorities; The inability of the parties to the contracts with the company to execute as agreed; social or paint disturbances Changes in commodity costs and failure of exploration systems or studies to generate the expected effects or effects that would justify exploration, studies, progression or ongoing operations.

While the forward-looking statements contained in this press release are based on what the Company’s control believes to be moderate assumptions, the Company warrants to investors that the actual effects will be consistent with such forward-looking statements. These forward-looking statements are made as of the date of this press release and are expressly qualified in their entirety through this warning. Subject to applicable securities laws, the Company assumes no legal responsibility to update or revise the forward-looking statements contained herein, to reflect occasions or cases that occur after the date of this press release.

The Company’s actual effects may differ materially from those expected in these forward-looking statements due to the points set out in the “Risk Factors” segment and the Company’s control report for the 3 and six months ended June 30, 2020.

https://www.newsfilecorp.com/release/61360 “data-reactid” 528 “To see the original edition of this press release, https://www.newsfilecorp.com/release/61360