“o. itemList. length” “this. config. text. ariaShown”

“This. config. text. ariaFermé”

AutoNation, Inc. (NYSE: AN) just released its quarterly report and things look bullish. Overall, this is a positive result, with revenue exceeding expectations of 4. 2% to be successful at $ 5. 4 billion. AutoNation also reported a legal benefit of $ 2. 05. 34% more than analysts expected. This is a vital time for investors because they can track the functionality of a company in their report, take a look at what the experts predict for the coming year, and see if there has been a replacement in the company’s expectations. We’ve combined the most recent after-earnings forecasts to see what the estimates recommend for next year.

See our latest research for AutoNation

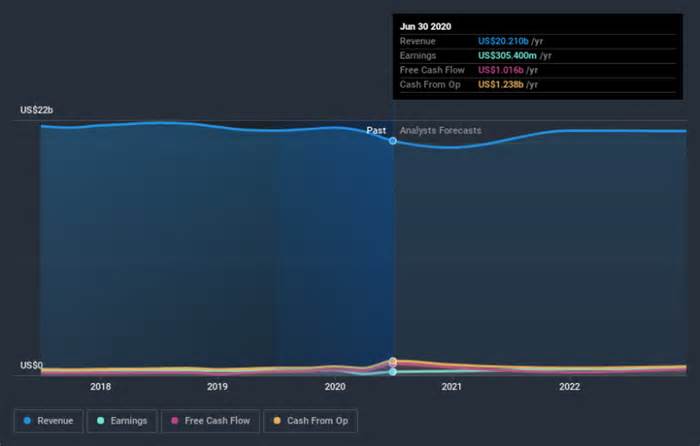

Based on the most recent results, the most recent consensus for AutoNation of 11 analysts is a profit of US $ 21. 3 billion in 2021, which, if achieved, would constitute a credible increase of 5. 6% in sales over the subsequent 12 months. The consistent percentage is expected to rebound 51% to $ 6. 56. In preparing the report, analysts had modeled earnings of US $ 21. 1 billion and earnings consistent with a consistent percentage (EPS) of US $ 6. 03 in 2021. Analysts appear to have more positive results on activity. , judging from your new earnings consistent with consistent estimates with consistent percentages.

The consensus value target remained unchanged at US$68. 00, implying that the balance of staggered profits is not expected to have a long-term effect on shareholder cost-creation. It might also be instructive to take a look at the diversity of analyst estimates to assess the difference between outliers and averages. There are other conceptions consistent with AutoNation, with the maximum positive analyst stimating it at US$78. 00 and the lowest at US$54. 00 consistent with participation. This shows that there is still some diversity in the estimates, but analysts do not seem to be completely divided into inventory as if it were a scenario of good fortune or failure.

Another way to view these estimates is in the context of an overview, for example, how the forecast compares to beyond functionality and whether the forecasts are more or less positive with other corporations in the industry. For example, we note that AutoNation’s expansion rate is expected to increase significantly, with a profit expansion that is expected to be 5. 6%, well above its old 0. 4% year-consistent decline over the more than five years On the other hand, our knowledge recommends that other corporations (covered through analysts) in a similar sector see their profits accumulating 9. 1% consistent with the year. While AutoNation’s profits are expected to improve, analysts appear to remain pessimistic, predicting slower expansion than the sector as a whole.

The most important thing here is that analysts have updated their earnings consistently with consistent percentage estimates, recommending that there has been a marked accumulation of optimism towards AutoNation as a result of those results. Fortunately, analysts also reconfirmed their profit estimates, recommending that sales were following expectations: our knowledge recommends that AutoNation’s profits deserve not be consistent with those of the industry as a whole. There has not been a genuine replacement in the consensus value objective, recommending that the intrinsic cost of the company has not undergone any primary adjustments with the most recent estimates.

With that in mind, we still think that the company’s long-term trajectory is much more vital for investors to consider. We have forecasts for AutoNation until 2022, and you can see them loose on our platform here.

Even in this case, know that AutoNation shows four precautionary symptoms in our reversal analysis, you know Array. .

This Simply Wall St article is general in nature. It does not constitute advice for buying or selling shares, and does not take into account its objectives or monetary situation. Our goal is to provide you with long-term research based on keep in mind that our research may not take into account the latest price-sensitive corporate announcements or qualitative information. Simply put, Wall St has no position on the above actions. Do you have any comments on this article?Are you concerned about the content?Contact us directly. You can also send an email to Editorial-team@simplywallst. com.